Many people are talking about a surprise $1,390 deposit from the IRS. Some hope it will cover holiday shopping or bills. For families feeling tight budgets in November 2025, the idea is tempting. Social media is full of posts claiming the payment is coming soon. But is it real? The facts say otherwise.

As of November 10, 2025, the IRS has confirmed there are no new federal relief payments for 2025 or 2026. Claims circulating online are recycled hoaxes targeting people worried about inflation and rising costs. Here’s a clear guide to separate fact from fiction.

Key Takeaways

- No new IRS relief payments are scheduled for 2025–2026.

- Online posts claiming $1,390 deposits are hoaxes.

- Real money you can access: tax refunds, state rebates, and unclaimed stimulus.

- Always check IRS.gov or official state portals before sharing bank details.

- Scammers often use fake portals and text alerts to steal information.

Why This Rumor Is Spreading

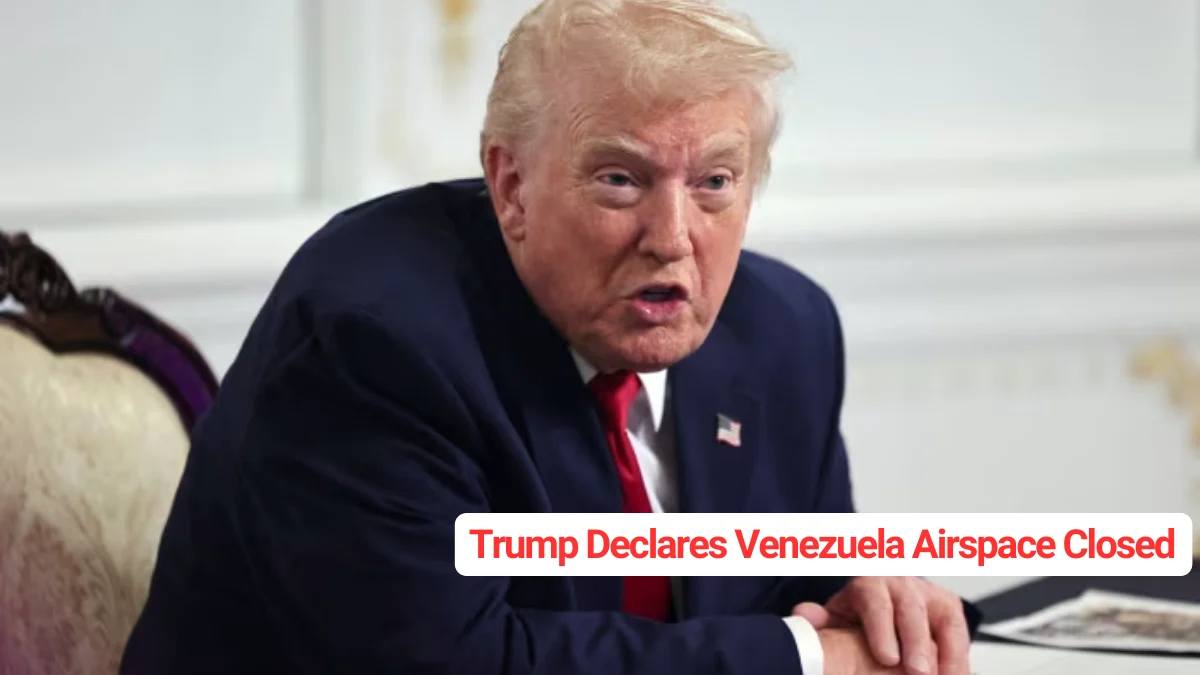

The rumor began in early October. Leaks about Trump’s tariff plans sparked hope of $1,000–$2,000 checks from trade revenue. By November 3, fake websites claimed $1,390 deposits would start immediately. Low-income families and Social Security recipients were targeted.

Social media buzzed with hope and warnings. Some posts highlighted scams, while others shared the rumor. Searches for “IRS $1,390 relief” spiked 300% from November 7 to 9. Most users reacted skeptically: around 70% doubted the claims, 25% vented about real money issues, and 15% hoped for relief.

How the Hoax Spread

| Date | Event | Platform | Impact |

|---|---|---|---|

| Oct 2025 | Trump’s tariff leaks start check rumors | X posts (@REDBOXINDIA) | Speculation grows, no facts |

| Nov 3-6 | Fake $1,390 alerts claim deposits start | Hoax websites (wcnh2024.com) | Confusion peaks, emails targeted |

| Nov 7-9 | Debunks published | News + X (@YahooFinance) | Users share warnings, bots fail |

| Nov 10+ | IRS issues scam alerts | IRS.gov, X threads | Focus shifts to real refunds |

These scams are recycled versions of 2021 COVID stimulus checks, updated with state programs like New York’s ANCHOR rebate. Scammers exploit holidays for clicks.

Separating Myths from Reality

Myth: $1,390 or $2,000 stimulus hits banks on Nov 3 via “Get My Payment” portal

Truth: No such portal exists. The old portal closed in April 2025.

Myth: Low-income people, seniors, or veterans can update bank info via text

Truth: IRS never asks for bank info by text or email. Reports phishing to phishing@irs.gov.

Myth: Tied to Trump tariffs or crypto dividends

Truth: Proposed rebates like the American Worker Rebate Act ($600–$2,400) have not passed. Tariffs are under court review.

Myth: “Anti-scam disclaimers” validate sites

Truth: Scammers use fake disclaimers. Always check IRS.gov for official guidance.

Real Payments You Might Receive

While no new federal relief exists, several legitimate payments are available:

| Program | Amount | Eligible Group | Status as of Nov 10 |

|---|---|---|---|

| IRS Tax Refunds | Varies | 2024 filers | Processing now |

| NJ ANCHOR | Up to $1,750 | Homeowners/renters in NJ | Checks mailing |

| NY Inflation Refund | Up to $500 | 2023 filers | Rolling waves |

| AK Permanent Fund | $1,702 | Alaska residents | Issued annually |

Other real options include unclaimed 2021 stimulus via amended returns. Federal workers affected by shutdown delays should receive back pay once resolved.

How to Protect Yourself

Scams thrive on urgency: “Claim now or lose it!” Experts recommend:

- Do not click unknown links.

- IRS will not charge fees or call unexpectedly. Forward suspicious texts to 7726 (SPAM) and delete.

- Update accounts only on IRS.gov or official state portals.

- Watch credible X accounts for alerts, like @CPA_Trendlines.

Looking ahead, proposed bills like the American Worker rebate may bring payments in 2026, but nothing is confirmed. For now, rely on state rebates and real tax refunds.

Bottom line: No magic $1,390 deposit exists. Stick to verified sources, avoid scams, and track legitimate relief from IRS and state programs.